OCTOBER 2020 PORTFOLIO UPDATE

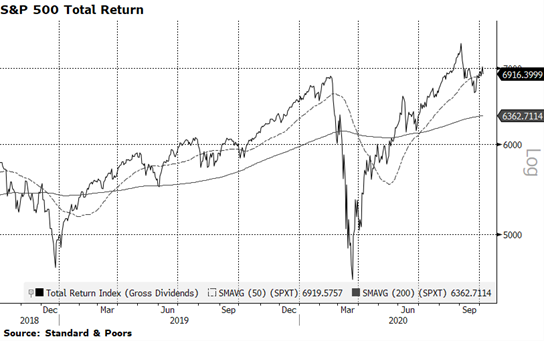

September was a volatile month across the globe as many markets pared strong advances achieved in the wake of March’s pandemic-induced lows. In the US, the technology-laden NASDAQ Composite Index entered correction territory declining 11.8% from its peak on September 2nd through September 23rd while the broader S&P 500 avoided a technical correction falling “only” 9.5% over the same period. Both indices have recovered some lost ground since then.

Given the strength of this past Summer’s rally and how extended the US equity market was at the end of August, the correction (or near correction in the S&P 500’s case) can be seen as justified and perhaps even healthy. Currently, both indices are trading at or above their respective 50-day moving averages and well above their longer-term trends. Asset prices have responded favorably to the tremendous amount of monetary and fiscal stimulus injected into the US economy over the past two quarters.

The economic impact from the stimulus appears to be gaining momentum. September’s labor market statistics exceeded economists’ expectations, with the unemployment rate falling to 7.9%. Private payroll employment rose by 877,000, although offset by a decline of just over 200,000 government sector jobs.

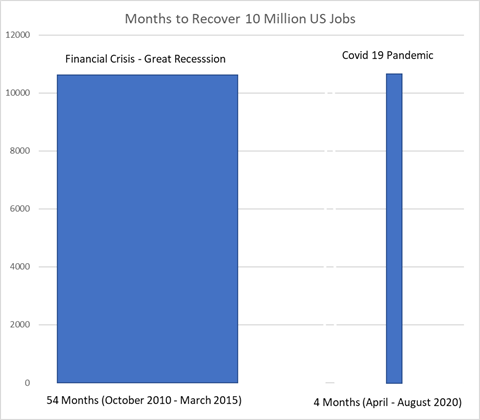

As we discussed several weeks ago in our blogs, over 10 million jobs have been recovered since April, a historically rapid pace of improvement. By comparison, it took 54 months, from October 2010 to March 2015, for an equivalent number of jobs to be recreated in the aftermath of the Financial Crisis. Still, there are nearly 13 million Americans out of work, which is seven million more than pre-pandemic levels and could take up to a year to return to normal. One source of optimism might be found in more populated states such as California, New York and New Jersey where the unemployment rates are above the national average, ranging from 10.9% to 14.5% due to longer and in some cases re-instituted economic lockdowns. If workers in these populous states can return to work as businesses reopen it could help improve the national labor market more rapidly.

Globally, there is encouraging news as trade trends are also rapidly improving. It is our opinion that the causal nature of this recession was highly unusual — near universal global government induced economic lockdown — so it is not all that surprising that the recovery could be quicker than normal. There does remain a high level of uncertainty that has prompted us to adopt a more cautionary stance, at least in the shorter term.

PORTFOLIO POSITIONING

Responding to near-term risks we previously cited in our Risk Outlook, we moved to an underweight in equities early in September. At the same time, we have remained underweight fixed income, and as a byproduct of both underweights we are now overweight cash. While exposure to global equities sits below benchmark levels, inside that allocation, the strongest conviction still resides in the US, and to a lesser degree in Asia x-Japan and Emerging Markets. Traditional developed non-US markets — the Eurozone and Japan — receive our lowest conviction, although only modestly so. Within fixed income, we are overweight in the US with a preference for mortgages and investment grade corporate credit. We have little to no exposure to non-US fixed income depending on the portfolio series. Overall, our portfolios continue to maintain lower duration than the benchmark.

RISK OUTLOOK

- National election campaign season is underway in the US as public health challenges and social unrest continue across the country. The country is wrestling with a history of socioeconomic, racial, and gender-based discrimination that has erupted into the town square as the pandemic further aggravated persistent inequities. The trauma is being socialized as rioting, looting and arson have devastated some businesses and communities trying to emerge from the pandemic lock-down. The election results could escalate emotions and hostilities causing further economic damage. We are also mindful of the consequences of persistent uncertainty from the process itself if results are not definitive soon after polls close given the time-intensive nature of counting mail-in ballots, or if we experience widespread ballot tampering or polling-site intimidation and lack of access that clouds the outcome of any races.

- Economies around the globe are on the path to re-opening but it remains to be seen how long the fallout will linger. Probably the most critical risk is the sustainability of the US economic and labor market recovery. Will the stimulus be enough? We are seeing positive recovery trends in the US labor market, but the world is a long way from full employment. Our concern is will we be pushing on a string later in the year and into 2021?

- The potential for an acceleration of virus cases coincident with the traditional Fall return-to-work and return-to-school season along with cooler weather that brings people back indoors is of great concern. Some US states are experiencing their first wave of infections and others which got an early handle on transmission are seeing resurgences, but with some bright(er) spots like New York, New Jersey and Connecticut that are in markedly better shape than mid-Spring. The ebb and flow of the virus’ toll on the human condition will likely weight on markets.

- Chinese Communist Party actions pose near and long-term risk. From aggression in the Asia-Pacific region to military tension along the border with India to suppression of Hong Kong citizens’ rights and the lack of contrition for their early role in failing to stop COVID-19 in its tracks, all may contribute to China-directed backlash or retaliation. There does seem to be regional coherency in the response as nearly all Pacific nations have aligned with the US against Chinese aggression. We continue to find it odd that the CCP has chosen hostility when they arguably need the rest of the world for their own recovery efforts in their weakened economic condition. From lack of respect for intellectual property rights to involvement in global criminal drug trafficking to financial crimes and human rights abuses bordering on genocide, the country is finding it harder to get the global community to look the other way.

- Accelerating and likely permanent changes to consumer behavior and global supply chains that in many cases were already under way and have been amped up by CoV-2 are likely to create further near- and long-term disruption but also opportunity as more local, sustainable and safe sources of goods and services emerge.

ESG CONSIDERATIONS

This has been a rough stretch for the US and its territories, from massive forest fires on the West Coast and in the Rockies to derechos in the heartland to massive and relentless tropical storms and hurricanes coming from the Atlantic. Anybody who has lived the damage wrought by these types of events understands they are fundamental and inseparable from the economy and investment. Here is a quick discussion of climate and weather using the same lens as we use on the capital markets: In the words of the National Oceanic and Atmospheric Administration (NOAA), “climate is what you expect, and weather is what you get”.

That is an oversimplification, but apt for putting it in our context. We would say that capital markets assumptions are what you expect, and performance is what you get. Capital markets assumptions are established based on long term historical observations, trend analysis, and calibration based on current inputs. For instance, while equities have generally performed a certain way since 1929, modern communications, computers, vastly larger economies and money supplies, and other structural changes and innovations change our expectations now and in the future. We cannot invest today assuming things will be for the next 100 years the way they were 100 years ago, regardless of what the history books say. Climate and weather are similar.

Glaciers, coral, trees, the fossil record and other naturally occurring phenomena serve the same kind of role as historical price charts and corporate records. They are an observable and quantifiable record of prevailing conditions (weather, atmospheric CO2, etc.) and the outcomes that resulted. In the markets, particularly with the perspective of time, we can see how large systems-level changes in inputs, like massive monetary stimulus or technological revolutions, change the behavior of the markets. In a similar way, systems-level changes in inputs to climate trigger change as well.

A Wall Street chartist like our own Doug Wilde draws considerable meaning from when a market is trending and making higher highs and higher lows. We are receiving the same signals in the weather, and those signals are persistent. Temperature, rainfall, storm propagation, and other types of observations are making higher highs and higher lows. These new observations which will ultimately be recorded in the long-term history captured by trees, ice, sediments, etc. are establishing the baseline for new climate assumptions going forward.

As long-term investors we look at companies, communities, countries and markets in terms of their potential return per unit of risk on an absolute basis as well as relative to the alternatives. In the case of climate, there is no alternative, or as climate scientists say, there is no Planet B. More importantly from our perspective, climate risk is investment risk. The world as we know it is based on a set of climate assumptions which determine where populations live, work, farm, fish, hunt, travel, extract, process and manufacture. If rivers dry up, forests burn, port cities are inundated, farmable land turns to dust, and oceans acidify, the assumptions on which investments are made in cities, companies, raw materials, or labor forces become irrelevant.

We therefore have to focus on how capital is allocated to mitigate or even reverse those risks where we can, and drive resiliency where we cannot. We are mindful of these macro-level risks across everything we do and have specifically crafted entire portfolios around these ideas in our ESG series.

October 2020 CAPITAL MARKET REVIEW

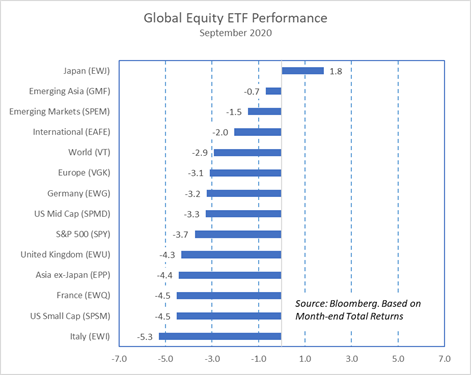

The strong Summer rally in many of the world’s capital markets was interrupted in early September with several equity and fixed income markets falling sharply.

Equity Markets*

Global equities declined 2.9%. Japanese stocks measured in US dollar terms bucked the trend and stood alone as the one positive performer in September. Emerging Asia and Emerging Markets overall outperformed, contracting a modest 0.7% and 1.5% respectively.

US stocks disappointed across the capitalization spectrum. Mid Caps fell 3.3%, Large Caps 3.7% and Small Caps 4.5%. Broad European bourses underperformed as well with the most acute drop in Italian equities which declined 5.3%.

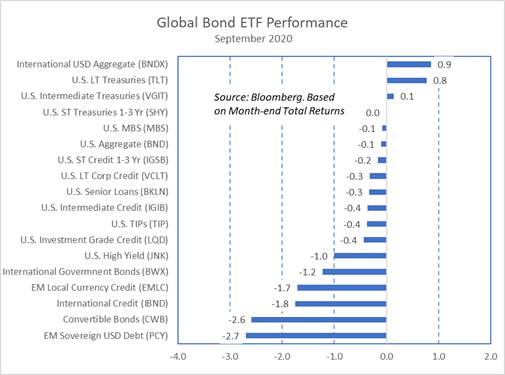

Bond Markets*

Higher risk areas of US fixed income traded lower with September’s equity market drawdown. US convertible bonds contracted 2.6% in the month after rallying nearly 25% from the beginning of June to the end of August.

According to the Bloomberg Dollar Spot Index, the US dollar rallied 1.39% in September recovering a degree from several months of weakness. The strong Dollar adversely impacted local currency-denominated international fixed income.

*The returns cited reflect total return performance of exchange traded funds listed in the corresponding bar charts

DISCLOSURES

Conscious Capital Wealth Management, LLC is a registered investment adviser. Information presented is for educational purposes only and does not intend to make an offer or solicitation for the sale or purchase of any specific securities, investments, or investment strategies. Investments involve risk and, unless otherwise stated, are not guaranteed. Be sure to first consult with a qualified financial adviser and/or tax professional before implementing any strategy discussed herein. Past performance is not indicative of future performance.

It is important to remember that there are risks inherent in any investment and that there is no assurance that any money manager, fund, asset class, style, index or strategy will provide positive performance over time.

Diversification and strategic asset allocation do not guarantee a profit nor protect against a loss in declining markets. All investments are subject to risk, including the loss of principal.

The information contained herein is based upon the data available as of the date of this document and is subject to change at any time without notice.

Portfolios that invest in fixed income securities are subject to several general risks, including interest rate risk, credit risk, the risk of issuer default, liquidity risk and market risk. These risks can affect a security’s price and yield to varying degrees, depending upon the nature of the instrument, and may occur from fluctuations in interest rates, a change to an issuer’s individual situation or industry, or events in the financial markets. In general, a bond’s yield is inversely related to its price. Bonds can lose their value as interest rates rise and an investor can lose principal. If sold prior to maturity, fixed income securities are subject to gains/losses based on the level of interest rates, market conditions and the credit quality of the issuer.

Foreign investments are subject to risks not ordinarily associated with domestic investments, such as currency, economic and political risks, and may follow different accounting standards than domestic investments. Investments in emerging or developing markets involve exposure to economic structures that are generally less diverse and mature, and to political systems that can be expected to have less stability than those of more developed countries. These securities may be less liquid and more volatile than investments in U.S. and longer-established non-U.S. markets.

An investment in small/mid-capitalization companies involves greater risk and price volatility than an investment in securities of larger capitalization, more established companies. Such securities may have limited marketability and the firms may have more limited product lines, markets and financial resources than larger, more established companies.

Portfolios that invest in real estate investment trusts (REITs) are subject to many of the risks associated with direct real estate ownership and, as such, may be adversely affected by declines in real estate values and general and local economic conditions.

Portfolios that invest a significant portion of assets in one sector, issuer, geographical area or industry, or in related industries, may involve greater risks, including greater potential for volatility, than more diversified portfolios.

Important Disclosures: Exchange-Traded Funds

Exchange-traded funds (ETFs) are investment vehicles that are legally classified as open-end investment companies or unit investment trusts (UITs) but differ from traditional open-end investment companies or UITs. ETF shares are bought and sold at market price (not net asset value) and are not individually redeemed from the fund. This can result in the fund trading at a premium or discount to its net asset value, which will affect an investor’s value. Shares of certain ETFs have no or limited voting rights. ETFs are subject to risks similar to those of stocks.

ETFs included in portfolios may charge additional fees and expenses in addition to the advisory fee charged for the Selected Portfolio. These additional fees and expenses are disclosed in the respective fund/note prospectus. For complete details, please refer to the prospectus.

For additional information regarding advisory fees, please refer to the Fee Summary and/or Fee Detail pages (if included with this report) and the program sponsor’s/each co-sponsor’s Form ADV Part 2, Wrap Fee Brochure or other disclosure documents, which may be obtained through your advisor.

Certain ETFs have elected to be treated as partnerships for federal, state and local income tax purposes. Accordingly, investors in such ETFs will be taxed as a beneficial owner of an interest in a partnership. Tax information for such ETFs will be reported to investors on an IRS schedule K-1. Investors should consult with their tax advisors in determining the tax consequences of any investment, including the application of state, local or other tax laws and the possible effects of changes in federal or other tax laws.