OCTOBER-NOVEMBER 2020 PORTFOLIO UPDATE

Global equities disappointed in October as coronavirus cases mounted across Europe and the US. Several large economies in Europe, including Germany, the United Kingdom, France and Italy, are returning to some form of economic lock down and the final outcome of US national elections is still in the balance. Early indications are that Democrats will maintain control of the House of Representatives and the Senate will remain under Republican leadership, although two Senatorial runoff races for early January in Georgia could shift that balance. The presidential outcome is yet to be certified and even amid this uncertainty US stocks are rallying in the early days of November.

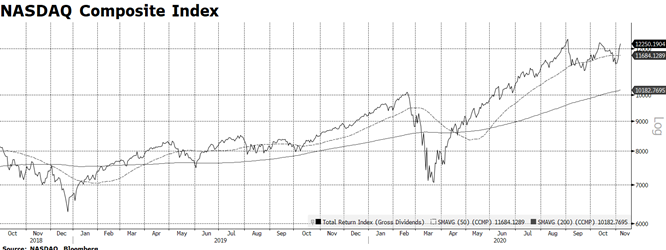

The technology-laden NASDAQ Composite appears on the way to testing the all-time high reached in early September. This is encouraging and at the same time curious. Several factors can explain the positive tone in US equity markets. First, an assumed static balance in the two houses of Congress would likely lead to no drastic change in US tax rates as any substantial proposed increase coming out of the House would stall in the Senate. We could expect a similar stasis in other core areas of the US economy and markets including energy policy, although some accord could emerge in an infrastructure package once further pandemic relief has been addressed. As we repeat in all other contexts, markets generally respond favorably to certainty, in this case around government policy.

Another round of stimulus will likely be delivered at some point before the end of the year, although the size and scope is a complete unknown at this point. This tranche of spending or relief we expect to be more targeted to areas of the country and economy most impacted by the deadly effects of COVID-19. Meanwhile, we see the Fed remaining accommodative for some time to come. Markets thrive with generous fiscal and monetary stimulus.

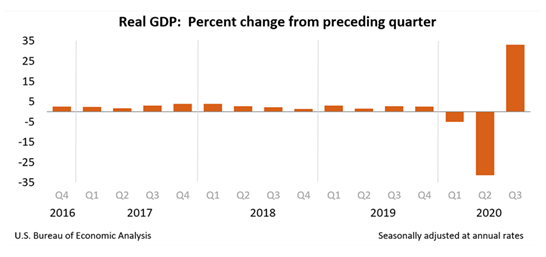

Further, the US economy is rapidly recovering. As many expected, the US economy rebounded strongly in the third quarter, exceeding economists’ forecasts. The BEA reported GDP grew at a 33.1% annualized rate while the consensus estimates stood at 32.0% prior to the announcement. The rebound is welcomed and necessary considering Q1 and Q2 contractions of 5.0% and 31.4% respectively. Strength was delivered across nearly all key sectors of the economy with the exception of Government Spending. The contraction in government expenditures stands in contrast to the tremendous amount of fiscal stimulus injected into the economy over the course of the year.

Personal Consumption Expenditures, the largest segment of the economy, grew 40.7% (annualized) in Q3, highlighted by an 82.2% advance in Durable Goods. Gross Domestic Private Investment expanded at an 83% clip. Exports and Imports also rebounded impressively. The recent report is headline grabbing, but the level of GDP is still some 2.8% lower than at this point last year. The key going forward is whether state and local lockdowns are lifted or are reinstituted as confirmed COVID-19 cases climb past prior peaks across the nation.

The following page details a summary of our portfolio positioning and the major risks we are following:

See the CCWM website for more market commentary or contact us with any questions.

PORTFOLIO POSITIONING

In terms of overall positioning, mindful of gyrations in the market we remain underweight equities for the time being, as well as underweight fixed income, leaving us with an overweight in cash and equivalents. Within global equities, we are modestly overweight with respect to the U.S., Asia x-Japan and Emerging Markets. We are neutral with respect to Eurozone stocks and underweight Japan. Within fixed income, we are overweight in the U.S. with a preference for mortgages and investment grade corporate credit. We have little to no exposure to non-U.S. fixed income, although there is more exposure to non-U.S. through Green Bonds in our ESG series portfolios. All portfolios holding fixed income maintain lower duration than the benchmark.

RISK OUTLOOK

- National elections in the US have concluded, but while there is a consensus media call that Mr. Biden is President-Elect, Secretaries of State across the country are still tabulating and finalizing vote counts and the Electoral College does not cast its 538 votes until the first Monday following the second Wednesday in December (December 14, 2020). Margins in several battleground states remain extremely thin and lawsuits are being filed by Mr. Trump’s camp contesting the legitimacy or timing of absentee or mail-in ballots. Low-probability outcomes that become reality can upset markets, so we remain watchful for any changes that could force market participants to reorder the assumptions on which they have been trading for the last many sessions.

- Social unrest is a major concern from a number of quarters. Protests from people aligned with both political camps have gone off-script and out-of-bounds by devolving into rioting, looting, vehicular assault, and other societally and economically damaging activities. We are concerned that the community damage caused in many cases overlaps where the impacts of COVID-19 are being most acutely felt and will hold back these communities from fully participating in the recovery that is underway which will stunt capital formation and job creation.

- The dreaded second wave of COVID-19 is upon us, striking Europe particularly hard and forcing governments to reinstitute economic lockdowns. The small-L libertarian streak in Americans makes it unlikely we will see a return to the Springtime shutdowns in coronavirus hotspots much less an Asian- or European-style total lockdown. At the headline level this makes it likely Europe in particular will economically lag other parts of the world while the US recovery will largely grind on with more targeted curtailing of economic activity like reducing concentrations at social gatherings and implementing late-night curfews on dining and drinking establishments. Regardless, we have to be mindful that rising infection rates as we enter the Winter months will have a meaningful effect on community healthcare infrastructure and will retard business and raise cost broadly, which will be a damper on upside potential. Mitigating that risk are promising signals on monoclonal antibody therapies and vaccines that could emerge in early- to mid-2021 creating the promise of a restoration of normality (or “new” normality).

- One of our long-term risk themes continues to be our focus on Chinese Communist Party actions which have not materially shifted for the better in the COVID era. From aggression in the Asia-Pacific region to military tension along the border with India to suppression of Hong Kong citizens’ rights and the lack of contrition for their early role in failing to stop COVID-19 in its tracks, all may contribute to China-directed backlash or retaliation. There does seem to be regional coherency in the response as nearly all Pacific nations have aligned with the US against Chinese aggression. We continue to find it odd that the CCP has chosen hostility when they arguably need the rest of the world for their own recovery efforts in their weakened economic condition. From lack of respect for intellectual property rights to involvement in global criminal drug trafficking to financial crimes and human rights abuses bordering on genocide, the country is finding it harder to get the global community to look the other way.

- Accelerating and likely permanent changes to consumer behavior and global supply chains that in many cases were already under way and have been amped up by CoV-2 are likely to create further near- and long-term disruption but also opportunity as more local, sustainable and safe sources of goods and services emerge. While seemingly imminent therapies are coming which have the potential to curtail or end the pandemic, 2020 has fundamentally reordered what it means for businesses to be resilient and what is required to operate reliably and efficiently under a variety of externalities. In main street terms, the “old ways” are not coming back and markets will need to process and reorient capital around the new order.

ESG CONSIDERATIONS

Performance. This topic has almost become the third rail of investment discussions where ESG is concerned. We are still dismantling a mythology that emerged in the 1980’s that investing with an eye toward economic, environmental and social justice was a concessionary strategy. Surely something must be given up in order to take on these bigger-picture issues. The truth (and the numbers) told a different story, and it has been possible, but not well accepted, to tell an evidence-based story about how ESG-centric investing is capable of delivering market-like returns with market-like risk.

Now we are faced with a more interesting problem. Over the course of 2020, ESG strategies, including our own multi-manager asset allocated portfolios, have dramatically outperformed their “traditional” counterparts. There has been a great deal of reticence to draw attention to this because the market giveth, and the market taketh away. Mean reversion is always lurking in the shadows of the market, and the price of a period of outperformance is almost always a period of underperformance to level the field. Don’t tempt fate. We have held fast to discussing ESG as a market-performing approach and assiduously avoided bringing attention to this moment of significant outperformance. Memories are also short – this happened before going through the Financial Crisis, so this is not entirely idiosyncratic. Put more simply, it isn’t a one-off.

Investors, analysts, journalists, and academics are asking versions of the same question – What’s going on? We would answer this way. ESG is not a style of investing. It is a discipline that crosses markets and permeates any type of investment strategy. When evaluated across the entire market space two factors seem to emerge as credible explanations for what, why and why now. The first is quality. Investments prioritizing environmental, social and governance considerations, whether corporate, municipal, residential, commercial, natural even tend to shake out as higher quality because more risks tend to be taken into account and addressed. A company that values workplace safety, community relations, environmental footprint, and non-toxic products is being managed in a way that is less likely to produce litigation risk, less likely to be subject to bookkeeping shenanigans, and less likely to trespass on the wrong side of the law. ESG tends to be a manifestation of quality behavior. There are of course moments in the market when quality does not matter at all, like in the late stages of the pre-Crisis bubble in 2007, and ESG (and quality) lag because investors will pay up for unlimited risk in the hopes of fantastic rewards. But, these more resilient, more flexible, better managed investments tend to outperform when the world spins off its axis.

The other factor is time. ESG-oriented investing restores the natural order of the market where value is priced more fundamentally and over market cycles rather than based on a quarterly earnings announcement or how many picoseconds of delay there are for the hedge fund whose servers are a block further away from the exchange than the competition. This is central to CCWM’s operating thesis of patient investing. Value is not realized in seconds or days in investments any more than you can grow your lawn that quickly. Investments that are valued and traded according to the long-term realization of value will tend not to get whipsawed around as much in crisis markets. ESG priorities often take years to play out so a committed investor must be patient to see them come to fruition.

It is not time to declare that ESG will always decisively outperform. There have been periods where ESG investments have been disadvantaged in the short term, and there almost certainly will be again. But, it is not unreasonable to look at how these investments behaved during moments of peak stress (like 2020) and their comparative performance over long periods of time and draw confidence that the market is signaling that quality and patience still matter, and that ESG represents an opportunity to invest in the classic sense rather than just trade.

OCTOBER 2020 CAPITAL MARKET REVIEW

October was an unusual month in global capital markets as both broad measures of equity and fixed income markets declined while higher risk segments rallied.

Bond Markets*

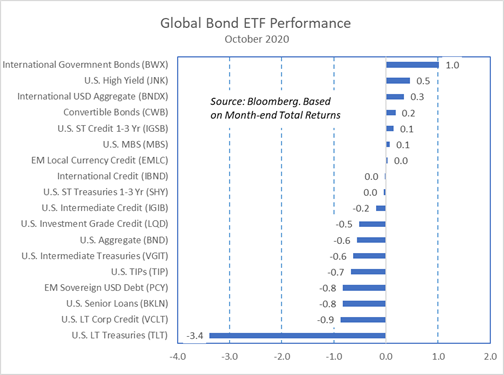

The yield on the US 10-year Treasury Bond rose 19 basis points in October, placing downward pressure on longer segments of US fixed income. Long-term US Treasuries fell 3.4% ,continuing their downtrend since mid-Summer.

Riskier areas of US fixed income, high yield and convertible bonds, posted modest gains which we find interesting given disappointing returns in US Large Cap equities.

The U.S. dollar declined 0.4% in October as measured by the Bloomberg Dollar Spot Index, fueling gains in dollar-denominated credit and sovereign bonds.

Equity Markets*

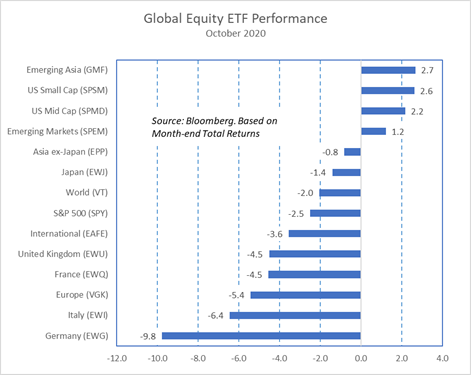

Global equities dropped 2.0% in US dollar terms while developed international and US large caps underperformed. The declines were most acute in European markets with Germany and Italy declining -9.8% and -6.4% respectively.

The higher risk areas within global equities notably outperformed, posting positive returns led by Emerging Asia climbing 2.7%. US Small and Mid Caps followed with advances of 2.7% and 2.2% sharply outperforming US Large Caps.

*The returns cited reflect total return performance of exchange traded funds listed in the corresponding bar charts

DISCLOSURES

Conscious Capital Wealth Management, LLC is a registered investment adviser. Information presented is for educational purposes only and does not intend to make an offer or solicitation for the sale or purchase of any specific securities, investments, or investment strategies. Investments involve risk and, unless otherwise stated, are not guaranteed. Be sure to first consult with a qualified financial adviser and/or tax professional before implementing any strategy discussed herein. Past performance is not indicative of future performance.

It is important to remember that there are risks inherent in any investment and that there is no assurance that any money manager, fund, asset class, style, index or strategy will provide positive performance over time. Diversification and strategic asset allocation do not guarantee a profit nor protect against a loss in declining markets. All investments are subject to risk, including the loss of principal. The information contained herein is based upon the data available as of the date of this document and is subject to change at any time without notice.

Portfolios that invest in fixed income securities are subject to several general risks, including interest rate risk, credit risk, the risk of issuer default, liquidity risk and market risk. These risks can affect a security’s price and yield to varying degrees, depending upon the nature of the instrument, and may occur from fluctuations in interest rates, a change to an issuer’s individual situation or industry, or events in the financial markets. In general, a bond’s yield is inversely related to its price. Bonds can lose their value as interest rates rise and an investor can lose principal. If sold prior to maturity, fixed income securities are subject to gains/losses based on the level of interest rates, market conditions and the credit quality of the issuer.

Foreign investments are subject to risks not ordinarily associated with domestic investments, such as currency, economic and political risks, and may follow different accounting standards than domestic investments. Investments in emerging or developing markets involve exposure to economic structures that are generally less diverse and mature, and to political systems that can be expected to have less stability than those of more developed countries. These securities may be less liquid and more volatile than investments in U.S. and longer-established non-U.S. markets.

An investment in small/mid-capitalization companies involves greater risk and price volatility than an investment in securities of larger capitalization, more established companies. Such securities may have limited marketability and the firms may have more limited product lines, markets and financial resources than larger, more established companies.

Portfolios that invest in real estate investment trusts (REITs) are subject to many of the risks associated with direct real estate ownership and, as such, may be adversely affected by declines in real estate values and general and local economic conditions.

Portfolios that invest a significant portion of assets in one sector, issuer, geographical area or industry, or in related industries, may involve greater risks, including greater potential for volatility, than more diversified portfolios.

Important Disclosures: Exchange-Traded Funds

Exchange-traded funds (ETFs) are investment vehicles that are legally classified as open-end investment companies or unit investment trusts (UITs) but differ from traditional open-end investment companies or UITs. ETF shares are bought and sold at market price (not net asset value) and are not individually redeemed from the fund. This can result in the fund trading at a premium or discount to its net asset value, which will affect an investor’s value. Shares of certain ETFs have no or limited voting rights. ETFs are subject to risks similar to those of stocks.

ETFs included in portfolios may charge additional fees and expenses in addition to the advisory fee charged for the Selected Portfolio. These additional fees and expenses are disclosed in the respective fund/note prospectus. For complete details, please refer to the prospectus.

For additional information regarding advisory fees, please refer to the Fee Summary and/or Fee Detail pages (if included with this report) and the program sponsor’s/each co-sponsor’s Form ADV Part 2, Wrap Fee Brochure or other disclosure documents, which may be obtained through your advisor.

Certain ETFs have elected to be treated as partnerships for federal, state and local income tax purposes. Accordingly, investors in such ETFs will be taxed as a beneficial owner of an interest in a partnership. Tax information for such ETFs will be reported to investors on an IRS schedule K-1. Investors should consult with their tax advisors in determining the tax consequences of any investment, including the application of state, local or other tax laws and the possible effects of changes in federal or other tax laws.