FEBRUARY-MARCH 2021 PORTFOLIO UPDATE

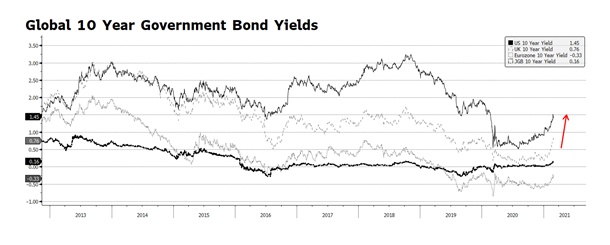

Equity markets around the globe were on edge as February came to a close. The technology-laden NASDAQ fell nearly 7% from an all-time high on February 12th. The weakness in equity prices came despite very accommodative comments from US Federal Reserve Chairman Jerome Powell during his scheduled two-day Congressional testimony in late February. Equity markets became unnerved as government bond yields began to rise at an accelerated pace in the US, Eurozone and particularly the UK. Benchmark interest rates have been rising since the beginning of this year and US interest rates have been climbing since last Summer signaling expectations of improving economic conditions in the months ahead. As long as the rate environment increases gradually, gains can continue in equity markets. But, as we witnessed over the past few weeks, a steep ascent in market interest rates will have an expected adverse impact on risk assets. [chart courtesy Bloomberg LP © 2021]

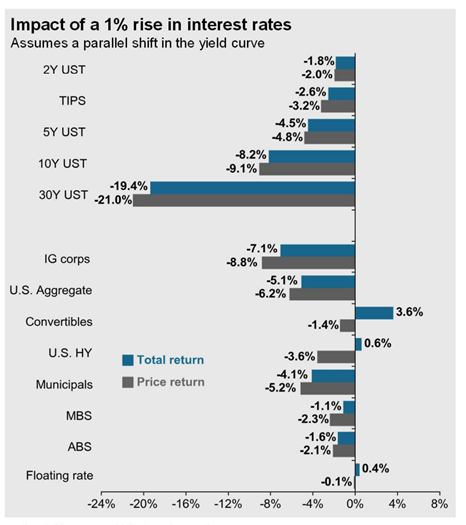

A few months ago, we highlighted a chart that came to us courtesy of J.P. Morgan Asset Management’s “Guide to the Markets” quarterly publication which expresses the near uniform adverse bond market impact of a nominal 1% rise across the yield curve. A key assumption cited in the chart subtitle is that the shift in the curve is parallel, which rarely happens, but illustrates a major challenge for US bond investors in the months ahead. There may simply be few segments within fixed income where investors can expect positive total return. It is reasonable to assume that the rise in intermediate-to-long term US Treasury rates will continue, eventually approaching pre-pandemic levels. The yield on the 10-year US Treasury has risen from 0.5% on August 4, 2020 to 1.41% on February 26, 2021, approaching the 1.77% of 12 months ago. According to JPM’s analysis, only US Convertibles, High Yield and Floating Rate securities, all of which exhibit some degree of equity-like behavior, can be expected to deliver modestly positive total return in the year ahead. There are other key assumptions that would change the results of their modelling such as benign equity market conditions and a steepening yield curve, but the chart illuminates the harsh reality facing bond investors in 2021.

The following page details a summary of our portfolio positioning and the major risks we are following:

See the CCWM website for more market commentary or contact us with any questions.

PORTFOLIO POSITIONING

After some level of clarity arose post US national elections we deployed our cash stock piles to US equity and fixed income. We now have a slight overweight allocation to equities overall and modest overweight to fixed income, leaving cash underweight. Within global equities, we are overweight with respect to the US, modestly overweight to Asia x-Japan and neutral with respect to Emerging Markets. We are neutral with respect to Eurozone stocks and underweight Japan. Within fixed income, we are overweight in the US with a preference for mortgages and investment grade corporate credit. We have little to no exposure to non-US fixed income except through Green Bonds in our ESG series portfolios. All portfolios holding fixed income maintain lower duration than the benchmark.

RISK OUTLOOK

- Any time government changes hands, even to successors within the same party, this introduces new uncertainties about legislative priorities, infrastructure, social programs, regulation and other areas influenced or outright controlled by government. The mix of governorships and State houses remained more or less the same after the 2020 election, but the Presidency and the US Senate switched party leadership. One-party control of Washington might suggest a dramatic agenda, but the party advantage in the House narrowed, and Senate control rests only with the VP tie-breaker. With the possible exception of the additional COVID-related stimulus which will be supportive of capital markets and enjoys broad support outside of DC, not a lot is likely to happen as far as bold policy initiatives. We expect to see smaller changes at the margin, in some cases walking back Republican priorities and in others advancing Democratic ones. We expect the market to be satisfied with stimulus plus incrementalism, and the risks will be found in targeted areas of the market and economy rather than at the headline level.

- Benign conditions do not always result in benign outcomes. As discussed elsewhere, even a slight normalization of the rate environment, which would reflect stabilizing economic conditions, could have profound effects in fixed income markets, severely dragging down assets like 30-year Treasury Bonds which are normally seen as safe harbors from risk. Wall Street has been cautioning about the risk of rising rates since the end of the Financial Crisis in 2009, but we have yet to actually have to live with those risks because a slow grind recovery followed by a series of crises including COVID have conspired to hold central bank policy where it has been – accommodative. Even a mild turn of phrase by the Fed Chair has resulted in temporary shocks in the bond and even equity markets, so we can anticipate that rising rates are not welcome in markets that have enjoyed easy money for more than a decade now. This compels us to think about risk in globally diversified portfolios differently, where the traditionally more conservative parts of asset allocations may actually represent more material risk in the nearer term.

- Big questions about the social contract will continue to play out in the months ahead. The ratio of constructive to destructive discourse and activism will weigh heavily on the impact to investors and the economy. Advancements in diversity, equity and inclusion, civil debate about justice reform, building back better and stronger as part of the COVID recovery, and improving participation in the US (and global) economy will be positive drivers. Putting that at risk, and with it capital formation and job creation, would be more violent and destructive actions that focus attention and resources away from serving and supporting the individuals and communities and their families, businesses and livelihoods who are struggling everywhere from the urban Northeast to the rural Southwest.

- As the “long, dark winter” as it has been variously described by public health officials comes to an end, we appear to have passed the transmission peak. Whether this is the byproduct of changing public policy, ramped up vaccine distribution, or personal behavioral adjustments, or likely some blend of all three, there is reason to believe the opportunity exists to begin thinking about a post peak-COVID world. We say “post peak” and not “post COVID” because we see a lack of certainty about the global community’s ability to put the coronavirus completely behind us as new variants circulate that are more transmissible and more infectious, such as the “UK” and “South Africa” strains which move more quickly and seem to beat social measures as well as the vaccines that are being deployed. At the same time, necessity being the mother of invention, businesses, schools, governments, and houses of worship are learning to function in the environment which is available to us, which means using a blend of immunization, public health programs, and behavioral adjustments like masks and social distancing to get to what may be a near-term “normal” where education, business, worship, entertainment and leisure can resume with strictures. We see the risk to achieving this near-term normal coming from strong resistance to participating in immunizations or simple lack of access to same, new and dangerous virus mutations, and other conditions which perpetuate the current Hobson’s choice of health and safety vs. education and a functioning economy.

- One of our long-term risk themes continues to be our focus on Chinese Communist Party actions which have not materially shifted for the better in the COVID era. From aggression in the Asia-Pacific region to military tension along the border with India to suppression of Hong Kong citizens’ rights and the interests of the Uighur population and the lack of contrition for their early role in failing to stop COVID-19 in its tracks, all may contribute to China-directed backlash or retaliation. There does seem to be regional coherency in the response as nearly all Pacific nations have aligned with the US against Chinese aggression. From lack of respect for intellectual property rights to involvement in global criminal drug trafficking to financial crimes and human rights abuses bordering on genocide, the country is finding it harder to get the global community to look the other way. We view this as a risk to investment in China and investment in companies reliant on a Chinese supply chain, but likely bullish for other parts of the Asia Pacific interested in usurping China’s role as the manufacturing floor for the world.

- Accelerating and likely permanent changes to consumer behavior and global supply chains that in many cases were already under way and have been amped up by CoV-2 are likely to create further near- and long-term disruption but also opportunity as more local, sustainable and safe sources of goods and services emerge. 2020 has fundamentally reordered what it means for businesses to be resilient and what is required to operate reliably and efficiently under a variety of externalities. In main street terms, the “old ways” are not coming back and markets will need to process and reorient capital around the new order.

ESG CONSIDERATIONS

As the uptake of ESG in the community of investors accelerates, more thought is being given to what ESG is (and is not). We have discussed previously how the market distinguishes between exclusionary (what not to own) and inclusionary (what to own) approaches, and the criteria that drive those distinctions. Our view of a comprehensive and integrated approach to ESG is one that establishes certain table stakes, the must-haves, certain absolute or at last near-absolute exclusions, the must-not’s, and an overarching expectation that the strategy must be geared to global systems change, the idea that ESG must be embraced at a deeply fundamentally level across the broadest swath of global business and global communities possible so that even small incremental changes have massive potential for systemic improvement.

Must-have’s

The characteristic we find common to the ESG investment managers to whom we commit client capital is a baseline policy around environmental, social and governance considerations that comprehensively informs their investment processes and portfolios. We do not include strategies that only contemplate a single facet or theme of ESG, such as only looking at workplace diversity or only looking at carbon footprint. The guidelines and principles of ESG are deeply intertwined, and you do not necessarily have a high-performing company or community because they address a single issue. While there are no perfect investments, we seek investments that more fully reflect an integrated approach to ESG that recognizes that economic, social and environmental justice come hand-in-hand.

Must-not’s

Some things are simply too egregious to own. While as a practical matter no screen is ever absolute, there are principles of exclusion which can apply when there is no visible path to a more just, equitable and inclusive world in a particular investment. Investing in companies or governments that do business with or support genocidal regimes is anathema. If there is irrefutable evidence of human trafficking and modern slavery, similarly that would lead to avoidance. The international Convention on Cluster Munitions addresses the humanitarian consequences and unacceptable harm caused to civilians by cluster munitions and provides a lens for excluding companies and governments that still produce or utilize this type of weaponry. Chemical weapons receive similar recognition and treatment. These are areas that are shocking to the extreme and tough to view as investable through the ESG lens, but they also represent a very small portion of the universe and do not represent a material sacrifice in terms of investment opportunity to leave out.

Global systems change

When the score sheets are tallied, the real question is how the world is better for having committed to an ESG investment approach. The path to improvement requires investing in small and targeted high-impact ways to drive rapid change and innovation, and in large and more general ways where broad but incremental changes made on a large scale can also be game changers. We look at it from a systems change perspective – how are changes implemented that fundamentally improve the operating parameters of global systems like water, climate, nutrition, health care, education, and economies. We also understand that these giant systems are also interrelated and interdependent. To understand these systems and break down the challenges to understandable and achievable goals, we embrace the United Nations Sustainable Development Goals, which offer us 17 big picture goals agreed upon by the UN’s members to be achieved by 2030, and 169 underlying targets for measuring progress toward the goals. A good ESG investment to us is one that advances one or more of those goals and does nothing to draw the global community backward on any or all of the goals.

FEBRUARY 2021 CAPITAL MARKET REVIEW

Global stocks posted solid returns in February overall even with equity prices weakening in the second half of the month. Fixed income continued to struggle with a few notable exceptions.

Equity Markets*

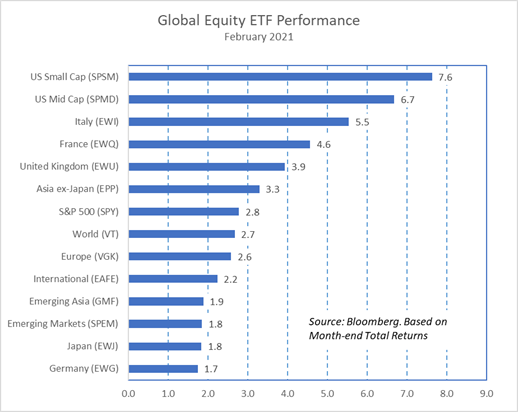

Global equities overall rebounded impressively in February rising 2.7%. However, the gains were stronger at mid-month than where we ended up. From February 16th to month end, global stocks declined 3.9% as government bond yields in several developed economies rose.

Stellar gains persisted in US Small Caps which rallied 7.6% in February. US Mid Caps built on January gains advancing a robust 6.7%. Italy, France, the UK and Developed Asia ex-Japan also outperformed the world while China’s correction dragged down returns in Emerging Markets.

Bond Markets*

The spike in yield on the benchmark US 10-year Treasury Bond forced longer duration fixed income instruments sharply lower. Long-term US treasury prices declined 5.7% following January’s 3.6% fall. The US dollar rallied 0.48% in February placing further downward pressure on international fixed income. The only bright spots in our fixed income group were US Convertible bonds, up 2.9%, and Senior Loans and High Yield Bonds both gaining a modest 0.2% in February.

*The returns cited reflect total return performance of exchange traded funds listed in the corresponding bar charts

DISCLOSURES

Conscious Capital Wealth Management, LLC is a registered investment adviser. Information presented is for educational purposes only and does not intend to make an offer or solicitation for the sale or purchase of any specific securities, investments, or investment strategies. Investments involve risk and, unless otherwise stated, are not guaranteed. Be sure to first consult with a qualified financial adviser and/or tax professional before implementing any strategy discussed herein. Past performance is not indicative of future performance. It is important to remember that there are risks inherent in any investment and that there is no assurance that any money manager, fund, asset class, style, index or strategy will provide positive performance over time. Diversification and strategic asset allocation do not guarantee a profit nor protect against a loss in declining markets. All investments are subject to risk, including the loss of principal. The information contained herein is based upon the data available as of the date of this document and is subject to change at any time without notice.

Portfolios that invest in fixed income securities are subject to several general risks, including interest rate risk, credit risk, the risk of issuer default, liquidity risk and market risk. These risks can affect a security’s price and yield to varying degrees, depending upon the nature of the instrument, and may occur from fluctuations in interest rates, a change to an issuer’s individual situation or industry, or events in the financial markets. In general, a bond’s yield is inversely related to its price. Bonds can lose their value as interest rates rise and an investor can lose principal. If sold prior to maturity, fixed income securities are subject to gains/losses based on the level of interest rates, market conditions and the credit quality of the issuer.

Foreign investments are subject to risks not ordinarily associated with domestic investments, such as currency, economic and political risks, and may follow different accounting standards than domestic investments. Investments in emerging or developing markets involve exposure to economic structures that are generally less diverse and mature, and to political systems that can be expected to have less stability than those of more developed countries. These securities may be less liquid and more volatile than investments in U.S. and longer-established non-U.S. markets.

An investment in small/mid-capitalization companies involves greater risk and price volatility than an investment in securities of larger capitalization, more established companies. Such securities may have limited marketability and the firms may have more limited product lines, markets and financial resources than larger, more established companies. Portfolios that invest in real estate investment trusts (REITs) are subject to many of the risks associated with direct real estate ownership and, as such, may be adversely affected by declines in real estate values and general and local economic conditions. Portfolios that invest a significant portion of assets in one sector, issuer, geographical area or industry, or in related industries, may involve greater risks, including greater potential for volatility, than more diversified portfolios.

Important Disclosures: Exchange-Traded Funds

Exchange-traded funds (ETFs) are investment vehicles that are legally classified as open-end investment companies or unit investment trusts (UITs) but differ from traditional open-end investment companies or UITs. ETF shares are bought and sold at market price (not net asset value) and are not individually redeemed from the fund. This can result in the fund trading at a premium or discount to its net asset value, which will affect an investor’s value. Shares of certain ETFs have no or limited voting rights. ETFs are subject to risks similar to those of stocks. ETFs included in portfolios may charge additional fees and expenses in addition to the advisory fee charged for the Selected Portfolio. These additional fees and expenses are disclosed in the respective fund/note prospectus. For complete details, please refer to the prospectus.

For additional information regarding advisory fees, please refer to the Fee Summary and/or Fee Detail pages (if included with this report) and the program sponsor’s/each co-sponsor’s Form ADV Part 2, Wrap Fee Brochure or other disclosure documents, which may be obtained through your advisor. Certain ETFs have elected to be treated as partnerships for federal, state and local income tax purposes. Accordingly, investors in such ETFs will be taxed as a beneficial owner of an interest in a partnership. Tax information for such ETFs will be reported to investors on an IRS schedule K-1. Investors should consult with their tax advisors in determining the tax consequences of any investment, including the application of state, local or other tax laws and the possible effects of changes in federal or other tax laws.