DECEMBER 2020 – JANUARY 2021 COMMENTARY

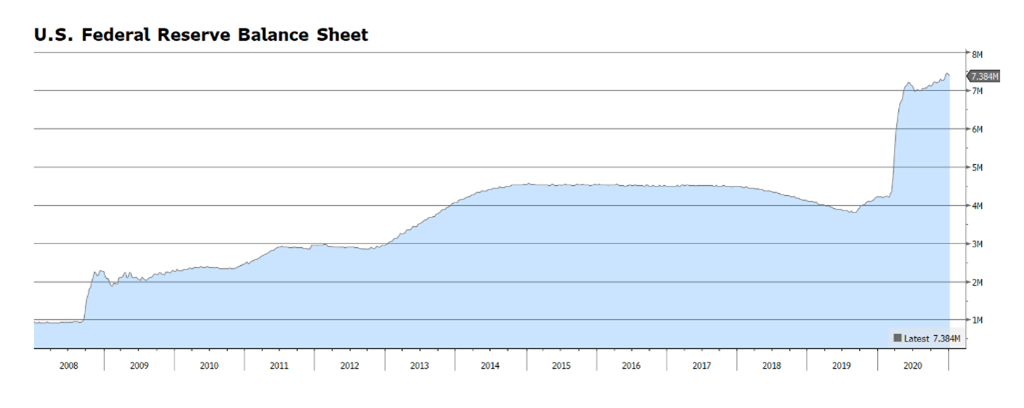

The extraordinary measures have been well documented that the US Federal Reserve has taken to support the economy, jobs and capital markets both at home and abroad. The balance sheet has expanded to $7.38 trillion, over $3 trillion in 2020 alone, and measuring from the Financial Crisis of 2008-09 the expansion is truly massive and poses the single largest risk to asset prices and the economy. Many fear that if the Fed begins to contract the balance sheet it could cause severe damage to asset prices and the world economy, especially if the incoming Biden Administration follows through on its campaign pledge to raise taxes on personal income, capital gains and corporations, all of which may not be supportive of economic activity. With slim Congressional majorities though, it will be difficult to alter tax policy through a vote. However, tax policy has been altered through budget reconciliation for over 25 years, including Clinton hikes in 1993, Bush cuts in 2001 and 2003, the new taxes of Obama’s Affordable Care Act in 2010, and finally Trump cuts in 2017. Given tax uncertainty, the Fed is unlikely to change course and work the balance sheet downwards any time soon and may even modestly expand it. We would also expect an accommodative Fed to maintain or even modestly expand its securities holdings. Our economic recovery remains tepid at best, and it would be hard for the Biden administration to justify any broad tax increase in the short-to-intermediate term.

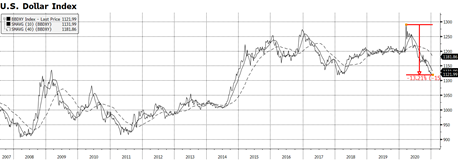

Capital markets continue to rally as yields on longer-dated US Treasuries climb higher and investors exit safe-haven investments. The US Dollar has shed a tremendous amount of value over the course of the pandemic. According to the Bloomberg Dollar Index (which measures a basket of leading currencies against the US Dollar) it has fallen over 13% since February and is trading at levels last seen in early 2018. We view the current weakness in the Dollar as an indication that conditions in the rest of the world are improving, critical as many countries are still being hampered by COVID-19 related outbreaks and lockdowns. Historically, dollar weakness has provided a tailwind for US multinational corporations through the currency induced earnings translation effect. That earnings boost from a weaker dollar will be needed given forward price-to-earnings ratios for large cap US stocks which are near or at all-time highs.

High aggregate US stock market valuations and price levels reflect the dominance of large growth companies, particularly in the technology sector. According to JP Morgan, as of December 31, 2020, 10 companies make up a record 28.6% of the S&P 500 market capitalization, a record surpassing the Tech Bubble at the turn of the Millennium. Market rotation may be overdue. US Large Cap Growth outperformance appears to be waning and value companies across the capitalization spectrum have been winning the performance “tug of war” versus growth companies throughout the duration of the pandemic.

[charts courtesy Bloomberg LP © 2020 – 2021]

The following details a summary of our portfolio positioning and the major risks we are following:

See the CCWM website for more market commentary or contact us with any questions.

PORTFOLIO POSITIONING

After some level of clarity arose as US national elections concluded we deployed our cash stock piles to US equity and fixed income. We now have a slight overweight allocation to equities overall and modest overweight to fixed income, leaving an underweight cash. Within global equities, we are overweight with respect to the US, modestly overweight to Asia x-Japan and neutral with respect to Emerging Markets. We are neutral with respect to Eurozone stocks and underweight Japan. Within fixed income, we are overweight in the US with a preference for mortgages and investment grade corporate credit. We have little to no exposure to non-US fixed income, although there is more exposure to non-US through Green Bonds in our ESG series portfolios. All portfolios holding fixed income maintain lower duration than the benchmark.

RISK OUTLOOK

- National elections in the US have concluded, but even the vote of the Electoral College was not sufficient to quell concerns or even outright unrest as it pertains to President-Elect Biden securing a win. We cannot take the rhetoric at all lightly, but the capital markets have shown an extraordinary ability to rebound from or even completely ignore domestic and global political turmoil in recent periods. Our view is that this is a reflection of confidence in the resilience of our system of government combined with the massive shock absorber that continuing legislative and monetary largesse provides to smooth over the proverbial bumps.

- Social unrest is a major concern from a number of quarters. Protests from people aligned with both political camps have gone off-script and out-of-bounds by devolving into rioting, looting, vehicular assault, and other societally and economically damaging activities. We are concerned that the community damage caused in many cases overlaps where the impacts of COVID-19 are being most acutely felt and will hold back these communities from fully participating in the recovery that is underway, stunting capital formation and job creation.

- The dreaded second wave of COVID-19 is upon us, striking Europe particularly hard and forcing governments to reinstitute economic lockdowns. The small-L libertarian streak in Americans makes it unlikely we will see a return to the Springtime shutdowns in coronavirus hotspots much less an Asian- or European-style total lockdown. At the headline level this makes it likely Europe in particular will economically lag other parts of the world while the US recovery will largely grind on with more targeted curtailing of economic activity like reducing concentrations at social gatherings and implementing late-night curfews on dining and drinking establishments. Regardless, we have to be mindful that rising infection rates as we live through the Winter months are having a meaningful effect on community healthcare infrastructure and will retard business and raise cost broadly, which will be a damper on upside potential. Mitigating that risk are promising signals on monoclonal antibody therapies and the deployment of three or four significant and effective vaccines in the US and Europe and by extension third-world countries that begin to put a timeline on a restoration of normality (or “new” normality).

- One of our long-term risk themes continues to be our focus on Chinese Communist Party actions which have not materially shifted for the better in the COVID era. From aggression in the Asia-Pacific region to military tension along the border with India to suppression of Hong Kong citizens’ rights and the lack of contrition for their early role in failing to stop COVID-19 in its tracks, all may contribute to China-directed backlash or retaliation. There does seem to be regional coherency in the response as nearly all Pacific nations have aligned with the US against Chinese aggression. We continue to find it odd that the CCP has chosen hostility when they arguably need the rest of the world for their own recovery efforts in their weakened economic condition. From lack of respect for intellectual property rights to involvement in global criminal drug trafficking to financial crimes and human rights abuses bordering on genocide, the country is finding it harder to get the global community to look the other way.

- Accelerating and likely permanent changes to consumer behavior and global supply chains that in many cases were already under way and have been amped up by CoV-2 are likely to create further near- and long-term disruption but also opportunity as more local, sustainable and safe sources of goods and services emerge. The pandemic experience of 2020 has fundamentally reordered what it means for businesses to be resilient and what is required to operate reliably and efficiently under a variety of externalities. In main street terms, the “old ways” are not coming back and markets will need to process and reorient capital around the new order.

ESG CONSIDERATIONS

Environmental, social and governance themes tend to be very long-term, playing out over market cycles, decades or even generations. It is the exact opposite of the market’s push to extract opportunity from signals that exist for picoseconds on electronic exchanges, where quite literally the distance of your servers from the exchange could make the difference in performance outcomes. Even so, there are a number of nearer-term sub-themes that we believe will be material to markets and portfolio performance in 2021. To a greater or lesser degree, they are all either caused by the pandemic crisis, or were already present but laid bare by the crisis. We will cover them in brief here and more comprehensively in a soon-to-be-issued CCWM piece on the year ahead in ESG.

- Setbacks to sustainable consumerism – Individual and institutional consumers have unavoidably veered away from best practices in everything from coffee cups to sterile wipes. The exploding use of personal protective equipment (PPE) in particular poses environmental challenges, as most of the material used is synthetic and, by the very nature of safety and health protocols, disposable. We are faced with a moment where making the conscientious consumption choice may not be the safest option, and this reversal will affect companies at all points in the supply chain from the component materials to end-of-life disposal.

- Re-examination of public transit – Public transit, a perennial ESG theme, had been enjoying something of a renaissance in usage and public sentiment, and in urban centers like New York City transit is not the sole province of the working poor. The pandemic exposed the public health risks of mass transit, as well as the usage risks when people stop commuting. Essential workers, among them the working poor, do not have transportation alternatives and can not “Zoom” in to their jobs, so ridership continues at some level. But usage has fallen and calls into question the stability and funding of mass transit systems certainly in the US but globally as well. When the demographics of ridership narrow, the interest in public support also narrows, which will have implications for transportation bonds, municipal financing for transit worker benefits and pensions, companies that supply and maintain equipment, etc.

- De-densification of population – Related to transit patterns, there has been a measurable flight from urban centers into the immediate suburbs to the exurbs and beyond. We believe to a certain degree this outward flow was already underway as Millennials, who were largely responsible for embracing urban living and driving the revitalization of city cores, began the inevitable transition to family life and the cherished qualities of open space, good schools, less expensive real estate, lower taxes, and greater mobility. Again, this is counter to the ESG theme of sustainable cities and dense and efficient living and working and may disrupt that investment thesis at least in the near term. The pandemic accelerated and amplified that movement, which has driven up real estate values outside of city centers, driven down real estate in the cities, and will cause a re-rating of the tax bases in both. We also expect this shift, combined with the move to virtualized office environments, to hollow out urban workspaces which will have implications for corporate office REITs and coworking companies.

- Shopping at home – Much like the acceleration of population flow out of urban centers, shopping at home has been a durable trend for some time now. It has also been a challenging trend from an ESG perspective because of the gained and lost efficiencies moving consumption online. The pandemic made these questions unavoidable as online shopping went from convenient to critical. There are tradeoffs in miles traveled for shoppers vs. miles traveled for delivery professionals. Packaging for shipment vs. packaging for shelved inventory poses another challenge. We have seen an ever-growing focus on the importance of logistics from warehouses to inventory management to GPS-driven transit to wring efficiencies out of the system, and now we expect that focus to shift more intensely to improving the sustainability of the business-to-consumer supply chain when the final mile is to the customer’s doorstep instead of a shopping mall shelf.

- Workplace safety – This is an ESG theme we have been focusing on in our publications since the beginning of the pandemic. Safety and health in the workplace took on entirely new parameters with COVID-19, redefining practices from offices to slaughterhouses and factory floors to grocery stores. We saw in the most graphic ways possible how workers in essential roles were not in a position to work remotely, and either had to face the risk of infection or the risk of unemployment. Safe and healthy workers are an ESG virtue, but they are also essential to resilient businesses and systems. Companies are being forced to rethink and invest in new environments, new resources and new processes in order to remain productive and economically viable under the strain of a public health emergency.

These are some of the headline themes on which we are focusing that are consequential in 2021 for people, planet and profit. We believe that these ESG themes have the power to drive markets and investment returns, and our ESG portfolios will continue to be composed of investment products and securities that address these near-term considerations while also keeping eyes on the horizon.

DECEMBER 2020 CAPITAL MARKET REVIEW

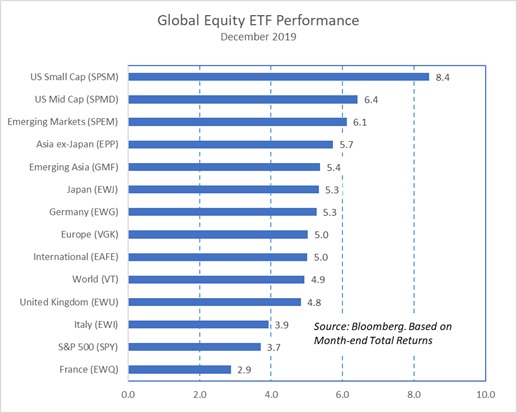

December was another dramatic positive month with global stock markets continuing to rally and several segments of fixed income markets delivering respectable gains.

Equity Markets*

Global equities added nearly 5% to their outstanding gains in December. US Small and Mid Cap stocks led markets with 8.4% and 6.4% gains respectively. Emerging Markets also outperformed while International Developed Markets, notably Japan and Germany, also delivered compelling relative returns.

The S&P 500 lagged international competitors yet still posted a respectable 3.7% gain in December. British stocks, perhaps sensing some Brexit progress, nearly kept pace with the world.

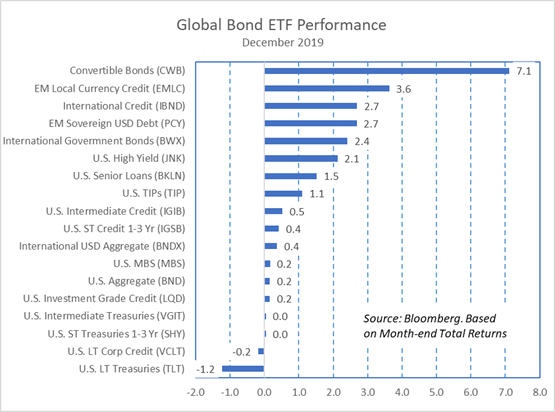

Bond Markets*

The interest rate environment was fairly calm in December with the yield on the benchmark US 10-year Treasury Bond rising 7 basis points to 0.92%. Credit sensitive segments of fixed income prospered, notably US Convertible Bonds which delivered another monthly gain comparable to US equities.

Dollar weakness persisted as a tailwind for international fixed income with both Emerging Market debt and Developed Market credit and sovereigns outperforming. The U.S. Dollar, as measured by the Bloomberg Dollar Spot Index continues its weakening trend, falling 2.2% in December.

*The returns cited reflect total return performance of exchange traded funds listed in the corresponding bar charts

DISCLOSURES

Conscious Capital Management, LLC is a registered investment adviser. Information presented is for educational purposes only and does not intend to make an offer or solicitation for the sale or purchase of any specific securities, investments, or investment strategies. Investments involve risk and, unless otherwise stated, are not guaranteed. Be sure to first consult with a qualified financial adviser and/or tax professional before implementing any strategy discussed herein. Past performance is not indicative of future performance.

It is important to remember that there are risks inherent in any investment and that there is no assurance that any money manager, fund, asset class, style, index or strategy will provide positive performance over time.

Diversification and strategic asset allocation do not guarantee a profit nor protect against a loss in declining markets. All investments are subject to risk, including the loss of principal.

The information contained herein is based upon the data available as of the date of this document and is subject to change at any time without notice.

Portfolios that invest in fixed income securities are subject to several general risks, including interest rate risk, credit risk, the risk of issuer default, liquidity risk and market risk. These risks can affect a security’s price and yield to varying degrees, depending upon the nature of the instrument, and may occur from fluctuations in interest rates, a change to an issuer’s individual situation or industry, or events in the financial markets. In general, a bond’s yield is inversely related to its price. Bonds can lose their value as interest rates rise and an investor can lose principal. If sold prior to maturity, fixed income securities are subject to gains/losses based on the level of interest rates, market conditions and the credit quality of the issuer.

Foreign investments are subject to risks not ordinarily associated with domestic investments, such as currency, economic and political risks, and may follow different accounting standards than domestic investments. Investments in emerging or developing markets involve exposure to economic structures that are generally less diverse and mature, and to political systems that can be expected to have less stability than those of more developed countries. These securities may be less liquid and more volatile than investments in U.S. and longer-established non-U.S. markets.

An investment in small/mid-capitalization companies involves greater risk and price volatility than an investment in securities of larger capitalization, more established companies. Such securities may have limited marketability and the firms may have more limited product lines, markets and financial resources than larger, more established companies.

Portfolios that invest in real estate investment trusts (REITs) are subject to many of the risks associated with direct real estate ownership and, as such, may be adversely affected by declines in real estate values and general and local economic conditions.

Portfolios that invest a significant portion of assets in one sector, issuer, geographical area or industry, or in related industries, may involve greater risks, including greater potential for volatility, than more diversified portfolios.

Important Disclosures: Exchange-Traded Funds

Exchange-traded funds (ETFs) are investment vehicles that are legally classified as open-end investment companies or unit investment trusts (UITs) but differ from traditional open-end investment companies or UITs. ETF shares are bought and sold at market price (not net asset value) and are not individually redeemed from the fund. This can result in the fund trading at a premium or discount to its net asset value, which will affect an investor’s value. Shares of certain ETFs have no or limited voting rights. ETFs are subject to risks similar to those of stocks.

ETFs included in portfolios may charge additional fees and expenses in addition to the advisory fee charged for the Selected Portfolio. These additional fees and expenses are disclosed in the respective fund/note prospectus. For complete details, please refer to the prospectus.

For additional information regarding advisory fees, please refer to the Fee Summary and/or Fee Detail pages (if included with this report) and the program sponsor’s/each co-sponsor’s Form ADV Part 2, Wrap Fee Brochure or other disclosure documents, which may be obtained through your advisor.

Certain ETFs have elected to be treated as partnerships for federal, state and local income tax purposes. Accordingly, investors in such ETFs will be taxed as a beneficial owner of an interest in a partnership. Tax information for such ETFs will be reported to investors on an IRS schedule K-1. Investors should consult with their tax advisors in determining the tax consequences of any investment, including the application of state, local or other tax laws and the possible effects of changes in federal or other tax laws.